Notes on Jeff Emmett's Rewriting the Story of Human Collaboration (Or, an Introduction to Token Bonding & Curation Markets)

https://blog.goodaudience.com/rewriting-the-story-of-human-collaboration-c33a8a4cd5b8

Key claim: DAOs are a new form of decentralized human collaboration

In the below presentation, I will discuss a new (and experimental) form of decentralized human collaboration — the curation market, how we can structure our economic incentives to more closely resemble stable networks found in nature, and how these cryptoeconomic primitives form the building blocks of a new cooperative framework for global action that can be used to solve the world’s biggest problems.

Summary

We have wicked problems which relate collective coordination problems (e.g. climate change)

Natural systems display complex behaviour based on interaction of agents following simple rules (e.g. ants following a trail, murmurration of birds etc)

[Editor: and ... markets with human beings - which he notes a few paragraphs later]

How can we create value signals in human networks to direct collaborative action without central authority?

How can we create value signals in human networks to direct collaborative action without central authority?

- Already exists with capitalism and markets

- How can we utilize market forces for the common good?

[Editor: note this is a great question and a very old and hard one. Most of human institutional innovation for a few thousand years or more relate to this question. It's a hard, hard problem with a huge associated literature.]

[!IMPORTANT] Author response: Yes it is, a literature which is gestured to through much of my research and writing. See paper on Challenges & Approaches to Scaling the Global Commons

For the first time, we can decentrally fund global projects and reward individual actions towards that goal without top-down organized leadership

For the first time, we can decentrally fund important global projects and reward individual actions carried out to help that goal without top-down organized leadership

- Like a charity of NGO but without the bureaucracy

🚩 Editor: This is a confusion of fundraising and allocation problems

This seems a basic confusion (and an "intellectual sleight of hand" - no doubt accidental): it confuses allocation and fund-raising aspects: just because we can do allocation decentrally doesn't mean we can raise the funds decentrally!

[!IMPORTANT]

Author response: This is not a confusion, nor a 'sleight of hand'. Fund-raising and allocation are both parts of the same complex adaptive system under discussion, and new tools bring new affordances that could help to address both the collection AND allocation of funds. So yes, we can now consider doing both decentrally - although 'decentralization' should not be an end goal in and of itself in any case.

How is the allocation model able to solve the fund-raising?

Editor: As we will say this problems is basically unsolved in what follows. Very similar to the issues with the claims made by Gitcoin's Kevin Owicki

[!IMPORTANT] Author response: Perhaps the issue you take is because you presume I am here to "solve" "problems"? I am merely discussing novel tools that open up new opportunities to think outside the box. Too bad this publication is not more open to that!

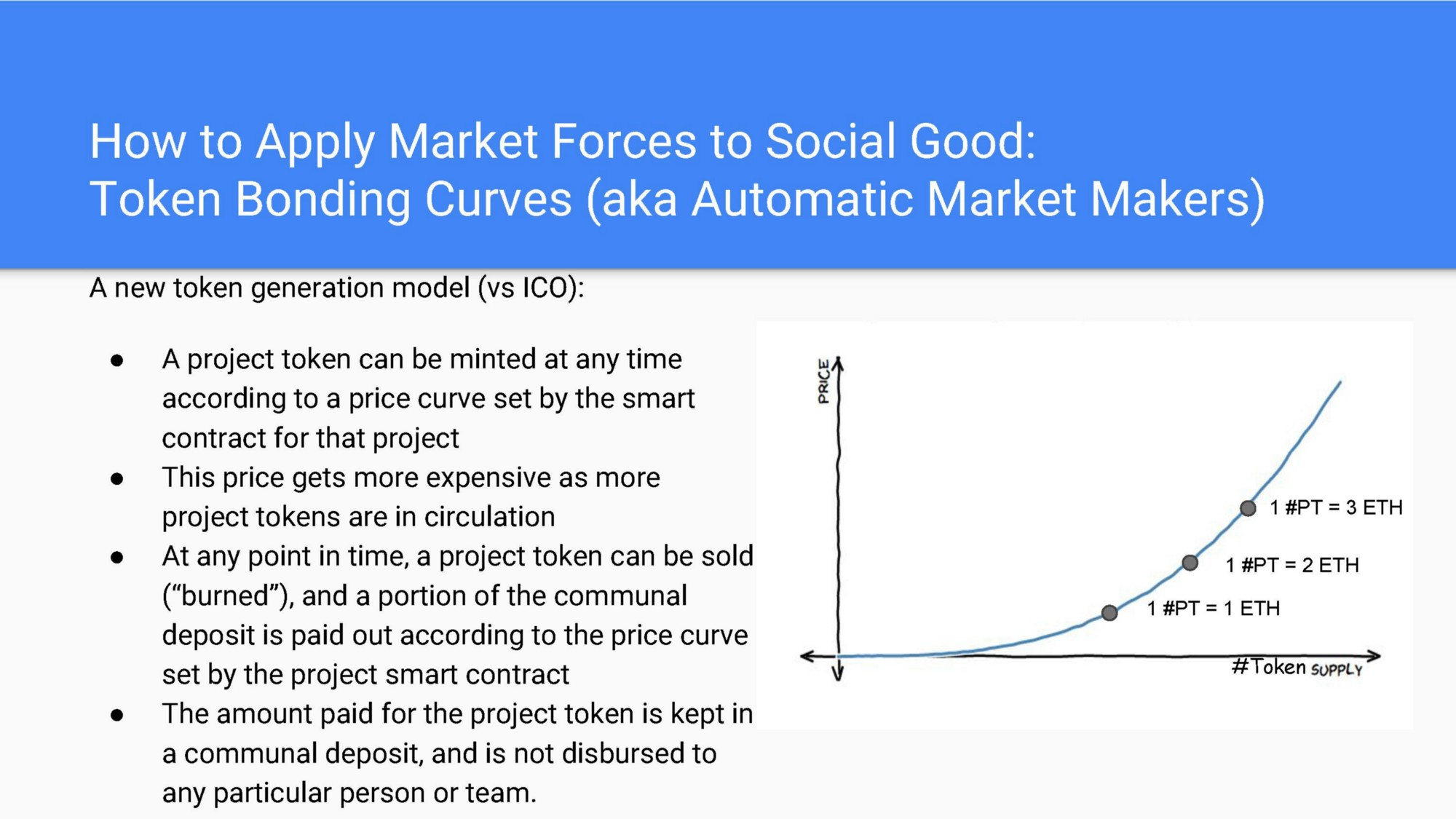

The model he describes is as follows

Then we have an an application example that he walks us through

And finishes with:

In some future scenario, the beaches in Thailand may have been cleaned up in large part, so fewer donations are needed. As #THC tokens are sold, their value decreases according to the token bonding curve, and the donation network smoothly winds down to a smaller level of operation, commensurate with its needs. (Granted, this could go many different ways depending on your sell curve properties — thus the importance of bonding curve parameters!)

Editor: Let's walk this through: it's either ponzi like (some people don't get paid back) or it runs on donations

- The only difference from classic donation is the weird possibility of speculative profit from the gradually rising payout value ...

- But given the zero sum aspect of in and out (ETH can't get created out of thin air) and the 50% allocation to the actual project this is only possible either with ponzi like mechanics where either people keep joining to pay out the early investors or the later "investors/donors" end up out of pocket (i.e. they just donate).

[!IMPORTANT] Author Response: Your self-imposed 'weird' dichotomies do you no favors in understanding the potential of these tools. To say these tools are "either this or that" puts you into a limited space of ideation around the use of these new tools and the novel affordances they offer. You could quite easily integrate donation systems with price fluctuating tokens, there are many leading web3 projects such as Giveth that work to navigate the tensions inherent in these tradeoffs (whether successfully or not, you can't say it isn't happening!).

Editor: There is also no mention of how this is verified or governed. Either way it doesn't seem to solve the free rider problem and the funding of public goods

[!IMPORTANT] Author response: Again, too bad this publication is willing to throw out the baby with the bathwater so quickly. Perhaps you should read more of my work and that of other relevant academics and builders in the Crypto Commons space.

Though the example above is very basic, it shows some interesting properties. It encourages donations to successful causes, while also providing network liquidity for goal completion, and a potential investment opportunity for donors and project participants at the same time. A project able to bootstrap funding and token value along with project success and popularity, yet also remain light on infrastructure, with the ability to wind down gradually as a problem is resolved and the project requires less funding — that’s a powerful idea.

Editor: How does it encourage donations to successful causes? (Or, at least any more than the current system?) The point that money can pay out is nice though one could build that into most existing orgs relatively easily (just track who contributed). It does not seem a very powerful or important idea.

[!IMPORTANT] Author response: In this article, donations were encouraged through the profit incentive - in the same way that traders are incentivized to find undervalued and overperforming companies to invest in on the stock market, we can now consider situations where philanthropic investors might do the same for impact outcomes. That is not to say it's easy, or a silver bullet solution...but I would be curious what ideas you think are more important than re-aligning the broken incentives of our current neoliberal economic order? 🤔

Claims seem large against the backing analysis

Editor: The thing for me is how so many things are claimed with very little to back them up.

The true benefit of a model like this, however, would be opening up the ability to create these movements to absolutely anyone in the world, with permissionless, direct, incentivized global participation.

Wait a moment this is only true for the entity setup but includes none of the governance and distribution of funds.

[!IMPORTANT] Author response: Again, perhaps you should read more of my work, and that of the organizations and toolkits I have helped to build in the interim since this was published. This was a single article written for a high level audience over 5 years ago.

Summary

The critique (as often) is good: yes, traditional organizations are slow and inefficient. Also solving global collective actions are politically and socially very hard ...

But ... we haven't been shown how token bonding curves really help at all.

[!IMPORTANT] Author response: This is your second "summary", and it doesn't summarize much. If you can't see any interesting properties in these new tools, perhaps it is because you don't seem willing to consider the possibility that new ideas may exist outside of your seemingly narrow perspective. To be honest, it appears that your responses are largely ideologically-driven critiques, which is rather disappointing and not at all in the spirit of 'steelmanning' that Rufus said he stood by in our interview.

Asides

Market forces for fairness

Market forces prioritize good information, disincentivize bad actors

🚩 Editor: But information systems aren't markets or democracies ... and if they were, then simply building good informational voting systems would have been a solved problem years ago ...

[what's surprising is you have (what I believe) is a really progressive person making very market-fundamentalist arguments. It's like the American Enterprise Institute approach to solving the climate crisis ...]

[!IMPORTANT] Author response: I would agree that I'm a progressive person, but I am also a rationalist. I do not believe that we can be purists or ideological in the ethical design of these new organizational structures. I am not a fundamentalist when it comes to market structures or mechanisms that could be useful in the contextual navigation of real world challenges. Many of the false dichotomies you have imposed throughout this analysis sound similar to the excuses and equivocations used by the mainstream economic powers to maintain our collective ignorance over more equitable economic alternatives - I just wish you wouldn't be so fundamentalist about it.